David Sandlin, a business teacher at Walton-Verona High School (Walton-Verona Independent), talks with student Anna Myers during his financial literacy class. Sandlin said a law passed earlier this year that establishes financial literacy as a requirement for graduation should help put students on the path to financial independence and success.

Photo by Megan Gross, Nov. 19, 2018

- A new law calls for the Kentucky Board of Education to establish academic standards and a graduation requirement for financial literacy.

- The new law does not require a specific course, only that “courses or programs that meet the financial literacy standards” will be required for graduation.

By Mike Marsee

mike.marsee@education.ky.gov

David Sandlin has seen what a strong foundation in personal finance can do – and what can happen to people who don’t have one.

Sandlin worked as an investment consultant prior to becoming a business teacher at Walton-Verona High School (Walton-Verona Independent), where he has spent the past 23 years. He teaches financial literacy in a school at which that course has fulfilled an economics graduation requirement since 2010.

He said the decision by the Kentucky legislature earlier this year to establish financial literacy as a requirement for graduation will change lives.

“It will be a game-changer for many of our students and hopefully put them on the path to financial independence and success,” Sandlin said. “I’ve seen the people who know how to do it and the people who don’t, and the dramatic difference in the two. I think if you give students that foundational knowledge about personal finance, it will empower them to make good financial decisions. They’ll start off on the right foot and avoid those pitfalls that so many people fall into.”

A bill that was passed by the General Assembly in March and took effect in July calls for the Kentucky Board of Education (KBE) to establish academic standards and a graduation requirement for financial literacy.

The law, which will be in effect for students entering high school beginning in 2020, was designed to ensure that students are taught how to budget, save and invest.

The law does not state that schools must teach a specific course, only that “courses or programs that meet the financial literacy standards” will be required for graduation.

“The goal for the financial literacy standards will be not to replace what is in the revised career studies standards, but to build on the whole progression,” said Teresa Rogers, a consultant with the Kentucky Department of Education’s (KDE) Office of Career and Technical Education. “Districts will have the autonomy to decide how to offer those standards to their students.”

The task of developing standards and the guidance for their implementation falls to KDE. Rogers, who is helping to direct that process, said it is imperative that students be taught financial literacy.

“Many young adults don’t know how to manage money,” Rogers said.

She said students don’t necessarily learn things such as the implications of student loan debt, establishing a good credit rating, managing household finances and saving and investing for retirement the way they once might have.

“So many students don’t have access to that information themselves to build that knowledge of how to use money,” she said.

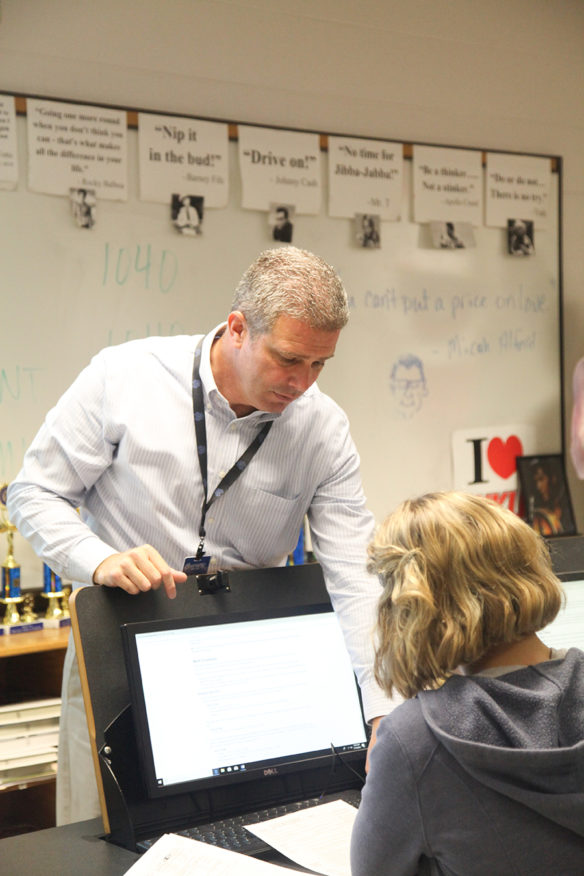

David Sandlin makes a point to student Cameryn McPherson during Sandlin’s financial literacy class at Walton-Verona High School (Walton-Verona Independent). Sandlin, who worked as an investment consultant prior to becoming a teacher, will serve on both a business and education advisory panel and a standards revision and writing committee during the process of developing financial literacy standards.

Photo by Megan Gross, Nov. 19, 2018

Rogers said financial literacy is taught in many schools, but it hasn’t been a requirement for graduation in most district. It is currently incorporated into the Kentucky Academic Standards for Vocational Studies from the primary level through high school, and KDE’s website offers links to several financial literacy and personal finance resources.

The new law does not state that schools must teach a specific course, only that “courses or programs that meet the financial literacy standards” will be required for graduation.

“The goal for the financial literacy standards will be not to replace what is in the revised career studies standards, but to build on the whole progression,” Rogers said. “Districts will have the autonomy to decide how to offer those standards to their students.”

At KDE, the process of developing the financial literacy standards is just beginning. The first meeting of a business and education advisory panel was held Nov. 28. Their work will provide guidance for a standards revision and writing committee, which will meet Dec. 4-5.

The first group is made up of educators from the high school level and representatives from business and industry and higher education; the second will consist of high school educators and at least one representative from higher education. Rogers said there was no shortage of people who wanted to be involved in the process.

“We had a huge outpouring of responses – about 150, all of them fully qualified – so I think that validates the need for this,” she said.

The two groups’ meetings should result in a draft of standards that will be made available for public comment in February. Work will continue into the summer, with the goal of taking the standards to KDE for a first reading in August.

Sandlin is serving on both the business and education advisory panel and the standards revision and writing committee.

“I was fired up, very passionate in my application. I’m not a big meeting guy, but I put everything I had into getting on this committee,” he said. “I bring a unique perspective with my background and with teaching in a district where this is already a requirement.”

Sandlin noted that the bill introduced in the Kentucky House of Representatives referred to “critical knowledge and skills,” and he said his goals for the standards development process is to help them ensure that students can attain that critical knowledge.

“I really just want to see the students have that basic understanding of financial literacy and personal finance concepts,” he said. “I want them to be able to leave high school able to apply for a job, to apply for a bank account, to be able to say, ‘I might not know everything, but I know the first steps to financial independence.’”

MORE INFO …

Teresa Rogers teresa.rogers@education.ky.gov

David Sandlin david.sandlin@wv.kyschools.us

Leave A Comment